There are many potential challenges that face the VC & PE industry that investors need to be aware of. The Venture Capital Financing process is ever-evolving meaning investors need to keep their fingers on the pulse of the industry to make the best investment decisions possible…

For those without industry experience or previous background, how Venture Capital Financing often seems shrouded in mystery.

Our general perception is that they operate a crucial role in the market by connecting entrepreneurs with good ideas in need of capital.

However, while the companies that venture capitalists fund hit the headlines and turn entire industries on their heads, venture capitalists themselves are often kept in the shadows.

Those looking to enter VE & PE without industry connections or dedicated mentorship might find many roadblocks awaiting them; this post aims to uncover some of that mystery and analyse the psychology that drives venture capitalists throughout their decision-making processes…

Venture Capital: From Sourcing To Closing

Generally speaking, VC firms are not stepping over each other to disclose their highly guarded and coveted decision-making processes. We cannot presume to know the in’s and outs of major VC firms processes. We can however speculate on the general approach firms are taking to make the best investments possible;

Sourcing Deals

VC firms have a multitude of ways for acquiring investment potentials. VCs are not only investing in tech but utilising it also through the use of many SaaS applications now aimed at the VC industry.

No matter how hard we try to avoid our biases, Investing can often be driven by emotion, so it should be no surprise the vast majority of deals result from referrals from those that are known or trusted. Failing this, VC firms undoubtedly have a litany of start-ups from direct application processes.

Initial Screening

Time is money. Therefore most VCs are looking to say no as quickly as possible to enhance time management and wade through the thousands of applications accrued.

Research suggests that the average Pitch Deck View lasts no more than 3 minutes and 44 seconds, so you need to be succinct and to the point – it’s estimated that 12% of investors will view Pitch Decks from their mobile devices, so despite your hosting platform make sure that its mobile optimised!

Initial Meeting With Partner

This stage can be crucial as a firm decides whether they’re interested in learning more and pursuing a prospect further.

Liaising Between Partner & Start-Up

An associate will follow up with the partner’s questions for the start-up. The pitch deck and competition will have been thoroughly assessed and a decision will be made whether or not to proceed.

Due diligence Decision

Assuming the decision has been made to move forward this stage is dedicated to allotting time to the required due diligence activities, including but not limited to;

- A deep analysis of competitors.

- By consulting with technical experts.

- Validating revenues and costs through financial due diligence.

- Investment memos are prepared with recommendations on whether or not to proceed

Partner Meeting

An investment memo is presented to other partners before the final decision-making process, whilst this is firm-specific, a unanimous decision can often be required.

Deal Terms

This specifies how much and what type of financing is required and the terms and conditions regarding financing. Clear information regarding who makes what decisions and how powers are assigned. A shareholders agreement might be drawn up detailing what decisions require board or shareholder approval.

Closing

The final steps of the closing process will deal with any documents which need to be signed as well as the final transfer of funds to a start-up’s account.

This is an overview of how a standard VC deal might operate, however as mentioned the intrinsic details of each of these steps will be firm dependant.

For further in-depth research on this subject, this academic paper from Stanford University comprises a survey of 885 institutional venture capitalists from 681 firms on their decision-making processes – this should be considered essential reading to venture capitalists conducting competitive research.

Avoiding Bias and Information Overload When Preparing Portfolio

In this information age, investors are privy to the same biases, information overload, and general obstacles that are common to many industries.

Navigating these challenges and reacting accordingly can be a challenge but not impossible if you are aware of common pitfalls to be avoided.

Some common mental barriers that can arise in Venture Capital Financing include;

Information Overload

Big data has reared its head in every industry and VC is no different. Most investors are required to analyse a great deal of data, including technologies, markets, trends & business models. Having more information does not always translate into smarter decision-making. The more information investors receive, the more likely they are to believe they can make better decisions, but, in reality, more information simply increased their confidence and not the accuracy of their decision. Further, the accuracy of decisions can actually decrease with increased confidence.

Local Bias

Studies show that Venture Capital Financing favour businesses in close proximity to their investment firms. This bias may be the result of a desire for quick and easy access to information. It is easier to become familiar with ventures when information is easily accessible. Due to this entrepreneurs from unfamiliar territories are more likely to be rejected by investors.

Venture capitalists who are familiar with entrepreneurs are more likely to feel comfortable; their familiarity can affect their decision to invest in the venture.

Similarity Bias

In psychology, similarity bias refers to the tendency to categorize new acquaintances as similar to oneself even before meeting them. Education and work experience are two dimensions that can influence this.

If you went to the same school, worked at the same company, or had the same experience as the entrepreneur, you may be at risk of bias. The more similar people are, the more comfortable they feel, and the same goes for investors.

Anchoring

Anchoring refers to the tendency to base decisions too heavily on one characteristic or piece of information. Due to past experiences, investors may focus heavily on one aspect of the venture.

There is nothing more dangerous than an investor with “blinders” on. Needless to say, this can result in overlooking a critical fault in the business.

Venture Capitalists Are Looking For Really Large Exits

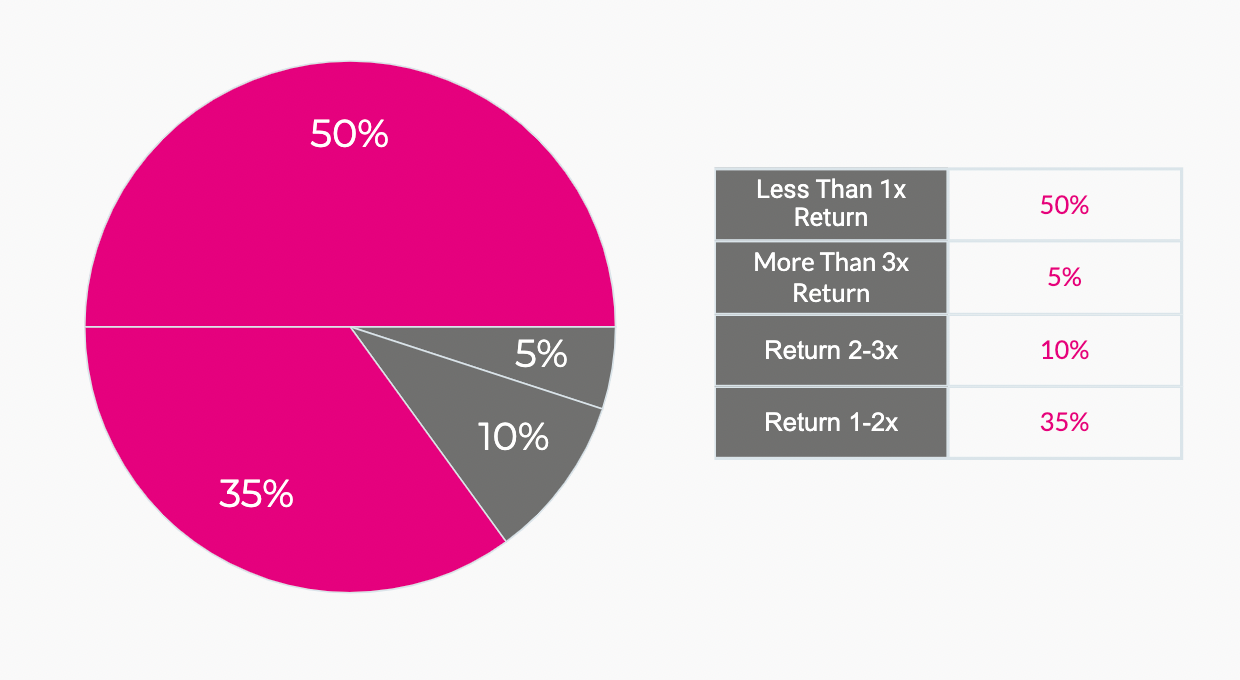

VCs sometimes target “smaller” start-ups with lower expected returns; but it’s often a fruitless endeavour as generally speaking with that strategy, it’s very difficult to return a fund multiple times.

Don’t be surprised if a majority of VCs reject your start-up. If your business is looking at less than a $100M valuation it may not be worth their time. The “Venture rate of return” is the benchmark consideration of a good investment. VC fund generally aims for a x3 to achieve the venture rate of return.

If a venture capitalist can invest at an $8M valuation, and the company exits at $100M; this would seem like a good investment, especially when you consider the stake you own in it.

Selling it for $100M sounds like an amazing outcome. In reality, a VC investing $100M invests $2M for 20%, adds further capital in subsequent rounds, and gets $20M upon exit (assuming no further dilution).

For a $100M VC fund, this simply doesn’t cut it – they need to get to $300M of returns. This is why VCs are aiming for huge outcomes.

Written by James Coffey