We hear the term “disruptive technology’ thrown around a lot these days. Its often used as a buzzword for hyping new products. If there’s one technology that has certainly impacted almost every industry its blockchain. Venture Capital Investors are beginning to feel this sea change, however, Blockchain is only just getting started…

People working in the tech industry are likely to be familiar with Blockchain and the cryptocurrency phenomenon, or will at least be aware of it to some degree.

However, there is no doubt that there cohort of investors who have yet to give it the time of day. Perhaps they are not investing in tech, and therefore have yet to come across blockchain opportunities. Perhaps they are Venture Capital Investors of an older generation; used to traditional forms of monetary investing yet to see the legitimacy of this digital revolution.

Maybe they simply haven’t seen the relevancy of blockchain in relation to their own personal goals or objectives; despite the fact, blockchain presents a solution to many of the challenges impacting VC today.

Whatever the reason there’s no denying this monumental technological development is not going anywhere anytime soon.

Cryptocurrency is here to stay and with that, the savviest investors are keeping a close eye on market developments to keep their finger on the pulse of the industry…

Introduction to Blockchain Technology

So, what is this Blockchain stuff all about? Blockchain can be as simple or as convoluted as you like. Gatekeepers of the crypto space tend to explain it in a confusing manner.

Blockchain at its core is a database, a collection of information stored in a ledger; comparable to that of a spreadsheet. Data is collected in groups or “blocks” which are then chained together in sequence. Upon the creation of a block, all previous information is comprehensively stored.

No information contained within a block can be edited or altered without affecting the entire ledger; this, in turn, creates a digital trail that is undeniable in its legitimacy and accountability.

The overarching blockchain objective is decentralisation – a self-sustaining, robust ecosystem that is independent of any one entity or organization.

In this article, we are not going to teach you how blockchain works; but a basic understanding is essential for understanding what it means for VCs.

To put it in relatable terms, blockchain and its associated technologies such as STO (Security Token Offering) and ICO (Initial Coin Offering) are directly comparable to IPOs (Initial Public Offering) in terms of their function. C

rypto start-ups are using these STOs and ICOs to achieve funding and investment similar to that of the VC industry.

But before jumping into the real-life applications of this tech let’s take a look at some of the developments and catalysts that have spurred this industry change…

The Necessity of Change

The term “Disruptive Technology” gets thrown around a lot these days; a buzzword that gets attributed to seemingly all the latest and hottest start-ups. These companies, albeit as exciting as they are often don’t live up to the revolutionary hype they have been given.

Real disruptive events and technologies are absolutely undisputable in the impact they have on an industry. Typically, disruptions arrive after a stagnant period, and their arrival will be a turning point for an industry. The venture capital industry is has a long illustrious timeline.

Its last defining developments and biggest moments happening when the tech bubble was in full swing in the late 1990s and early 2000s.

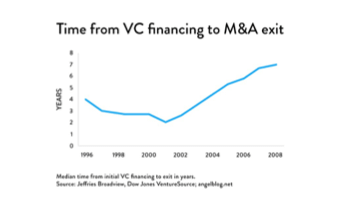

During the peak of the tech bubble in 2000, the average venture capital exit timeline was three years and dipped to two years in 2001.

A number of companies took advantage of the fervent interest in tech stocks and went public. In the end, an endless litany of IPOs led to the dot-com bubble bursting. In hindsight, this arguably changed venture capital for the better.

Investors were incentivising to ignore the FOMO and take a more calculated approach focusing on sustainable growth and customer and revenue generation over profits.

Blockchain is one recent development that can truly live up to the “disruptive technology” label. It’s impacted almost every industry – and perhaps it might just be the next logical step forward for Venture Capital. In 2021, we find ourselves in a familiar situation, with many institutions signalling another tech bubble looming, what can we do to make sure the same mistakes are not repeated?

In the wake of the influx of innovative, investment-worthy start-ups, VC firms have not been able to keep up with their demands to provide liquidity to every business with sustainable growth potential.

The Ease of Portfolio Diversification

Blockchain can help solve this issue by offering more liquid funds through the issuance of tokens that can be exchanged on cryptocurrency exchanges.

The introduction of this system in the financial world would revolutionize the way investors pursue technologies such as AI, IOT, etc.

As mentioned, Blockchain has made a considerable impact in other industries. It has opened up equity opportunities for both traditional and new investors.

With the growth of crypto and Blockchain fuelled by early adopters, efficiency, security, and reliability have improved significantly. Venture capitalists should start investing in Blockchain now. Blockchain start-ups have already raised thousands of times more money through ICOs than venture capital has invested so far.

This change is in line with the way people have approached investing from the beginning. Venture capitalists make use of their funds to support the development of new ideas and technologies.

Moving to the use of Blockchain will not only represent a change but will pave the way for a world where investments are more equal and stay within the regulations. As a result, start-ups and investors would both benefit from significant growth and increased liquidity.

Adoption of Blockchain by Venture Capital Investors

Throughout the decade we have seen a slow but steady adaptation to this new tech as Venture capital investment in cryptocurrency and blockchain start-ups continues to accelerate.

As the market is still in its infancy, the vast majority of investments have traditionally been seed-stage deals – 100% of all venture deals in 2012, and 70% in 2015.

A six-fold increase in venture capital investment occurred between 2013 and 2016. During the first quarter of 2016, blockchain investments outnumbered venture investments in Bitcoin start-ups by over five to one.

Representing a significant shift from 2015 when Bitcoin start-ups received venture funding at a much higher rate than blockchain start-ups.

Flash forward to the current day and banks and financial services companies have become the most active investors — either through internal venture capital arms or through other strategic initiatives.

The level of interest from these firms validates the value and potential of the technology and helps to build talent in the space. Among the most prominent players in the space are Goldman Sachs, MasterCard, American Express among other high-rollers.

Several venture capital firms have also focused exclusively on blockchain technology. Prominent examples include Blockchain Capital, Digital Currency Group, and Pantera Capital.

Today, more than 200 venture capital firms have invested $1.3 billion into companies within this emerging ecosystem, currently representing over 250 active start-ups.

The digital currency service Coinbase is a key player in the Crypto market; backed by venture capital firms such as Union Square Ventures and Andreessen Horowitz.

Tokens as New Funding Means

Now that we have an understanding of its roots and growing prominence let’s take a look at the real-world use cases for this tech in Venture Capital.

Those in the know can equate an ICO to IPO with ease, but what exactly is an STO? The Security Token Offering (STO) represents one of the new ways start-ups in the cryptocurrency and blockchain industry are raising funds.

Among their strongest attributes are the access to capital offered by global markets, the variety of available market offerings, and their low entry costs. Investors have increased security, and these funds should continue to grow, creating a staggering opportunity in the future.

However, not every start-up wants to handle every aspect of an STO on their own, so they seek other sources of funding.

In layman’s terms, The concept of security tokens is that they are essentially digital, liquid contracts for fractions of a well-known asset and Investors can expect to have their ownership stake preserved with security tokens on the blockchain. Check out this resource for further reading on the intrinsic impact STOs are having on VC.

Freedom of Digital Liquidity

Venture Capitalists are able to hold tokens in their portfolios and do trading whenever they like. As a result, investors have complete control and don’t have to wait to see whether the start-up will be successful. Furthermore, tokens allow investors to participate in a liquid environment while keeping the possibility of exiting more quickly.

In addition to increasing profit, this new model would also make Venture Capital more accessible. Investing in this sector has become easier thanks to the liquidity of the asset.

Those with the skills and determination needed to make it can afford to take part. In other words, this revolution would eliminate the strict requirement of committing to 3 to 5 years at the outset.

Even venture capital firms can benefit from making it possible for new investors to become involved. Following the success of ICOs, everyone can now invest.

STOs & ICOs are not the only elements shaking up VC, a full list of benefits far outstretch the scope of this article – check out the other way blockchain is impacting VC.

…

Blockchain’s evolution has been fascinating to watch. As of 2009, most of the discussions and efforts centered on the technology. In today’s industry, blockchain is becoming dominated by business and entrepreneurial drivers, rather than technological developments.

Every industry requires an overhaul periodically. Shaking up the venture capital industry and changing the status quo produces the best possible results for founders, investors and experts.

Considering we are still before the apex of mass adoption for blockchain and cryptocurrency, what the future holds is unpredictable – entrepreneurs and venture capitalists will want to watch this space closely – we know we will!